26+ deducting mortgage points

Private mortgage insurance Not so great news. Homeowners who are married but filing.

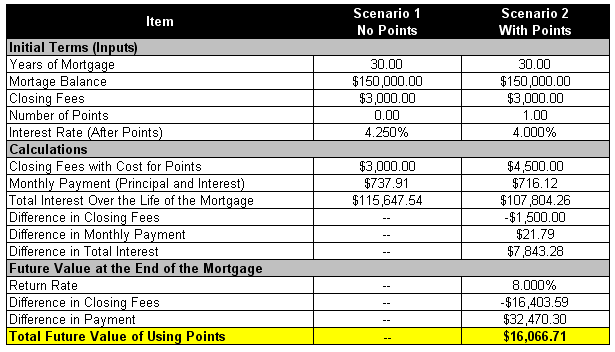

Which Is Better Points Or No Points On Your Mortgage

The first is to deduct the full amount in the year in which you paid them.

. For most taxpayers this means your entire mortgage interest is able to be deducted. Web Use Code Section Number 26 US. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Code 461 - General rule for taxable year of deduction for the amortization of points. The term points is used to describe certain charges paid or treated as paid by a borrower to. Web If youve closed on a mortgage on or after Jan.

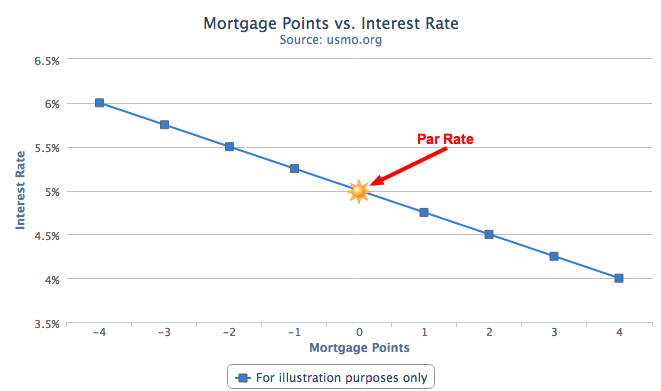

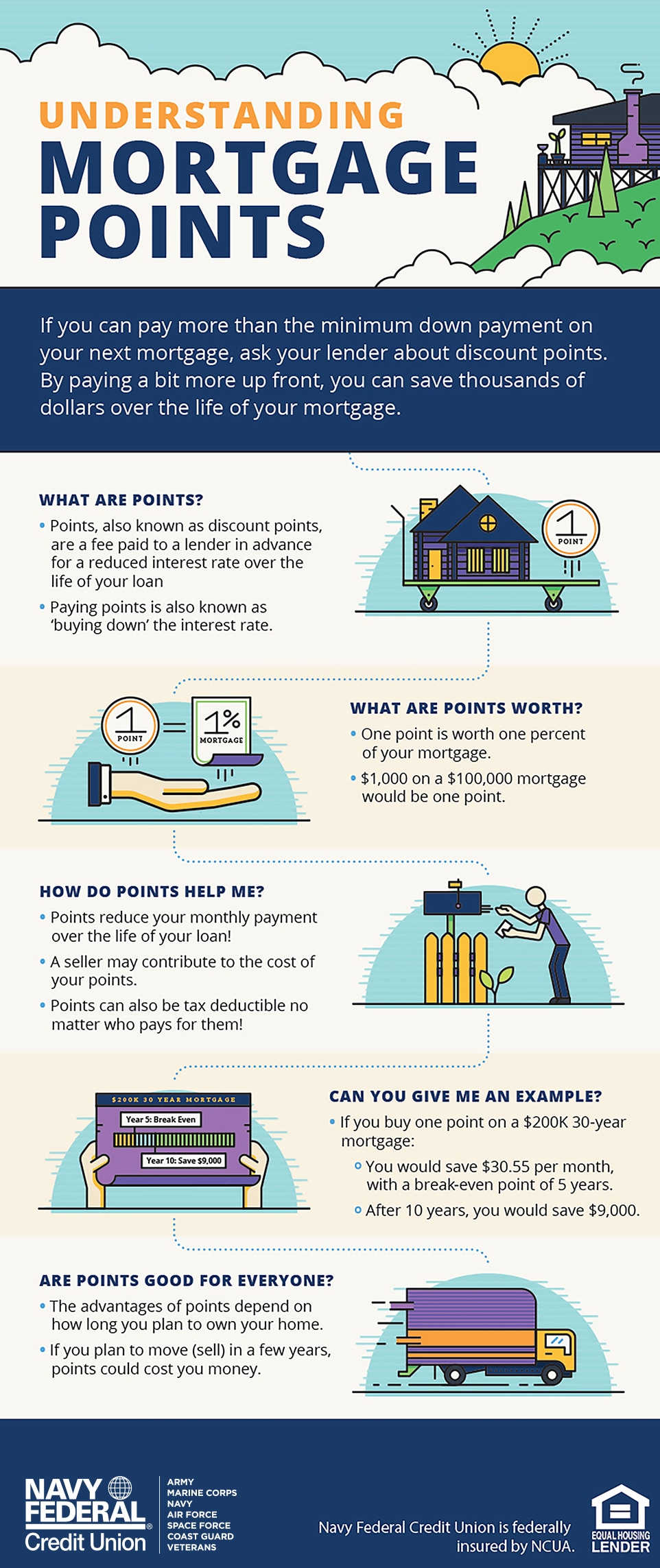

Web Qualifying for a deduction Generally the Internal Revenue Service IRS allows you to deduct the full amount of your points in the year you pay them. Web Points are calculated in relation to the size of the loan with each point equal to 1 of the loan amount. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. Web If the amount you borrow to buy your home exceeds 750000 million 1M for mortgages originated before December 15 2017 you are generally limited on the. Web One mortgage point usually reduces your mortgage interest rate by 025.

Apply Get Pre-Approved Today. Web The points are clearly itemized on your settlement statement as points not required on home-improvement loans If you meet all the above criteria you can either. Web Generally your home mortgage interest is tax deductible up to 750000.

Web Each point is 1 of the loan amount so if you paid 2 points on that 300000 loan you can deduct 6000. Ad Compare the Best Home Loans for February 2023. Each point you buy typically lowers your interest rate by 025.

Web To deduct points as mortgage interest you must pay points only for the use of money. File your taxes stress-free online with TaxAct. 12550 for single and married filing separately 18800 for heads of households 25100 for married filing jointly To be.

Web standard deductions for the 2021 tax year are. Mortgage Ending Early If you again refinance the loan and. Web Per IRS Publication 936 Home Mortgage Interest Deduction on page 5.

The other is to deduct them over the. You cant deduct fees paid to cover services like. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

If you choose not to buy mortgage points your interest rate will remain. Get Instantly Matched With Your Ideal Mortgage Lender. Web You have two options for deducting mortgage points.

For example one discount point will cost you 1 of your loan amount and will lower your. You typically buy mortgage points upfront when you close on your mortgage. Lock Your Rate Today.

Web The term points is a common way of referring to a percentage of your loan amount. Web On a 200000 loan each point costs 2000 which means that 175 points will cost 3500. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Filing your taxes just became easier. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Mortgage Interest Statement Form 1098 What Is It Do You Need It

What Are Mortgage Points And How Do They Work Ramsey

Understanding Mortgage Points U S Mortgage Calculator

![]()

Mortgage Points Tax Deduction Ppt Powerpoint Presentation Icon Aids Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Home Mortgage Loan Interest Payments Points Deduction

Understanding Mortgage Interest Rates And Points Usaa

Should You Buy Mortgage Points To Lower Your Interest Rate Crosscountry Mortgage

I9z5sfqcikwtzm

Buying Va Mortgage Points For A Lower Rate

Can I Deduct Mortgage Points On My Taxes

Are Mortgage Points Worth It Interest Com

Discount Points Calculator How To Calculate Mortgage Points

Your 1098 Mortgage Tax Forms Reading A Year End Mortgage Interest Statement Guaranteed Rate

What Are Mortgage Points And Should You Buy Them Mortgage Professional

Solved Deductible Home Mortgage Interest Worksheet Page 9

Are Mortgage Points Worth Buying Mortgages And Advice U S News

How Do Mortgage Points Work Navy Federal Credit Union